Star productsĬan be the market leader though require ongoing investment to sustain. Despite a serious amount of investment, it flopped and failed to compete against the established players such as Apple and Samsung. For example, Amazon (see the Amazon business model)developed the Firephone but failed to gain traction in the smartphone market. The challenge is that a lot of investment may be required to get a return. Question mark productsĪs the name suggests, these products often require significant investment to push them into the star quadrant. After SAAB ceased trading and producing new cars, a whole business emerged providing SAAB parts. For example, in the automotive sector, when a car line ends, there is still an after-market i.e. However, this can be an over-simplification since it’s possible to generate ongoing revenue with little cost. The recommended advice is to remove any dogs from your product portfolio as they are a drain on resources. Think of the BCG Matrix as mapping a portfolio of products or services. In other words, eighty per cent of profits come from twenty per cent of the products and therefore the BCG matrix provides a method to analyse your portfolio and decisions. The BCG is more relevant to larger organizations with multiple services and markets. However, smaller businesses that have a broad range of products can use this to analyse their products. Each quadrant represents a relative position based on market growth and relative market share. It’s also known as the Growth/Share Matrix. The Boston Consulting Group’s product portfolio matrix (BCG matrix) is designed to help with long-term strategic planning, to help a business consider growth opportunities by reviewing its portfolio of products to decide where to invest, to discontinue or develop products.

#Bcg matrix word template how to

Stars: Products in high growth markets with high market share.Ĭash cows: Products in low growth markets with high market share How to use the BCG Matrix model Question marks or Problem Child: Products in high growth markets with low market share. Pets are unnecessary they are evidence of failure to either obtain a leadership position or to get out and cut the losses.THE BCG Matrix What are the four quadrants of the BCG Matrix?ĭogs: These are products with low growth or market share. All products will eventually become either cash cows or pets. Companies should liquidate, divest, or reposition these “pets.”Īs can be seen, product value depends entirely on whether or not a company is able to obtain a leading share of its market before growth slows.

Companies should invest in or discard these “question marks,” depending on their chances of becoming stars. Companies should significantly invest in these “stars” as they have high future potential. Companies should milk these “cash cows” for cash to reinvest.

#Bcg matrix word template drivers

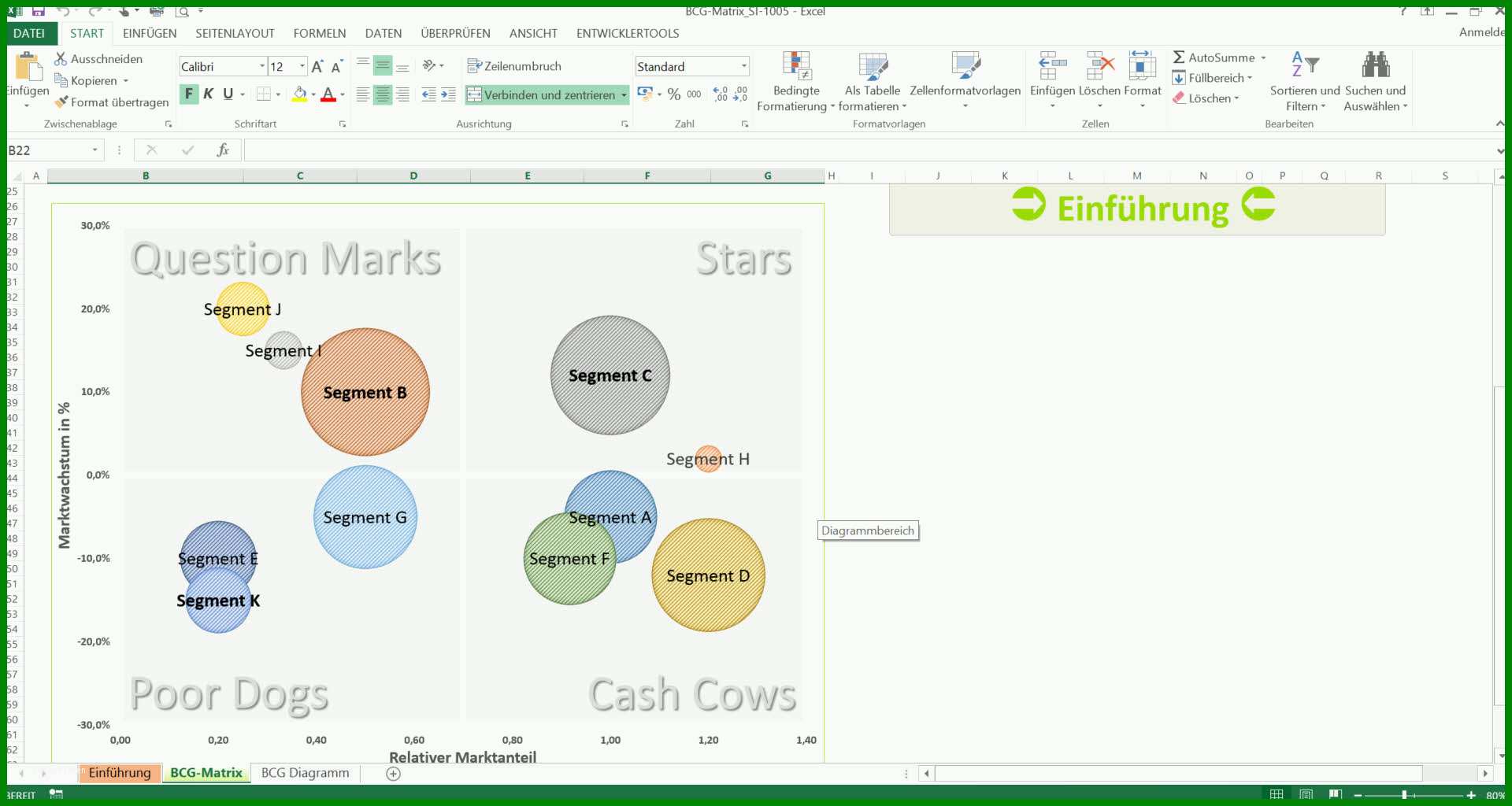

The matrix reveals two factors that companies should consider when deciding where to invest-company competitiveness, and market attractiveness-with relative market share and growth rate as the underlying drivers of these factors.Įach of the four quadrants represents a specific combination of relative market share, and growth: These high growth rates then signal which markets have the most growth potential.

Ultimately, the market leader obtains a self-reinforcing cost advantage that competitors find difficult to replicate. The growth share matrix was built on the logic that market leadership results in sustainable superior returns. The CEO’s Dilemma: Business Resilience in a Time of Uncertainty.Technology, Media, and Telecommunications.

0 kommentar(er)

0 kommentar(er)